WHY CHOOSE THE TAX SCHOOL DROP OUT?

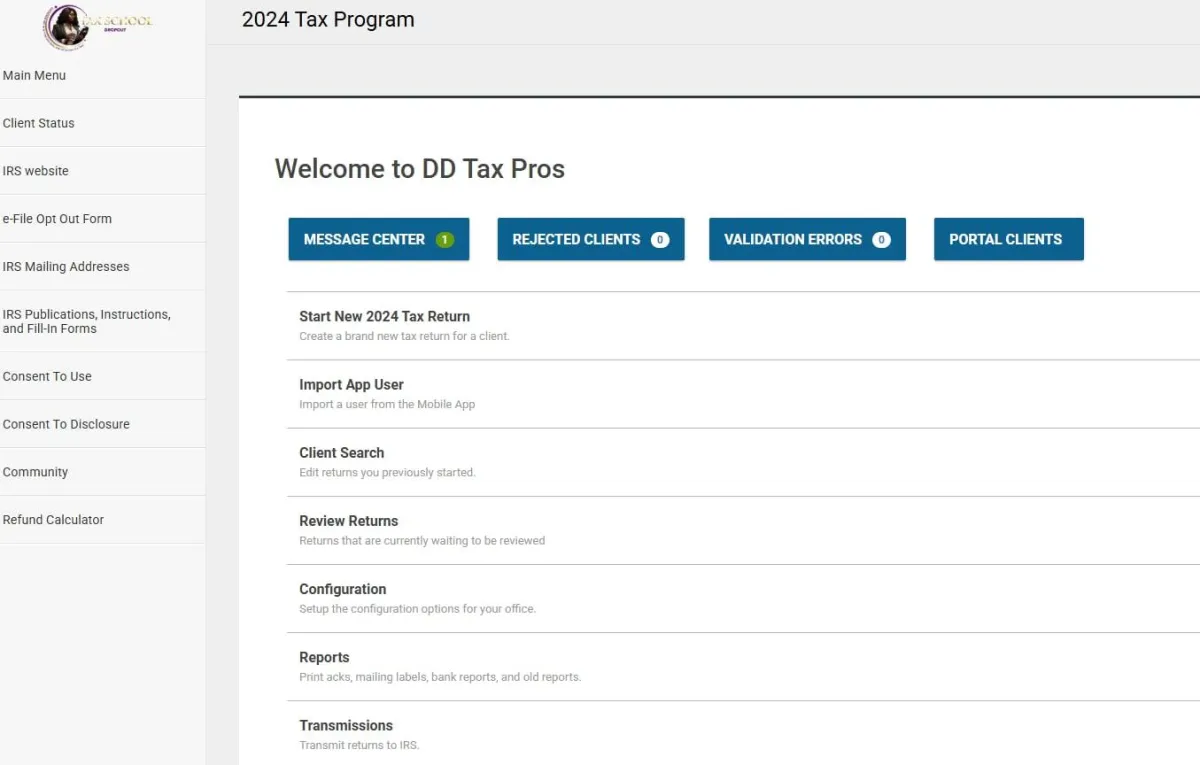

TAX SOFTWARE THAT WORKS AS HARD As You Do

Stop overpaying for complicated software. Our all-inclusive platform gives you everything you need to start earning.

✓ Seamless Federal & State Integration

✓ Automatic IRS Updates

✓ User-Friendly Interface

✓ Lowest Backend Fees in the Industry

✓ Mobile-Ready Design

"I made back my $250 investment with my first client" - Thomas J., $10K/month earner

Expert Training, Zero Fluff

Skip the textbooks. Learn exactly what you need to succeed - nothing more, nothing less.

• Step-by-Step Video Tutorials

• Real-World Case Studies

• Live Q&A Sessions

• Updated Tax Law Guides

• Business Marketing Templates

24/7 Support That

Has Your Back

Never feel stuck again. Get answers when you need them, not when it's convenient for us.

• Round-the-Clock ERO Support

• Live Chat Assistance

• Expert Tax Guidance

• Community of Tax Pros

• Weekly Success Calls

"The support team helped me land my first

10 clients!" - Sarah W., $5.5K/month earner

Real Stories, Real Success.

Thomas James, Atlanta, GA

“Before this program, I had zero experience in the tax industry, but within just 90 days, I went from clueless to earning $10,000 a month. The skills I gained have completely transformed my financial future and set me on a path I never thought possible!"

Sarah William, Houston, TX

“I spent years in a corporate job, but it never gave me the fulfillment or freedom I craved. This program changed all of that. In just one tax season, I replaced my entire salary, gained financial independence, and now I have the work-life balance I’ve always wanted.”

Bob Limones, Miami, FL

“I had enrolled in several other tax training programs before, but none of them gave me the real-world skills I needed to succeed. This program was a game-changer – it actually provided me with the tools and knowledge I needed to start earning and building a business in this industry.”

Featured Blog Posts

Recent Changes in the Industry and Why Having a Mentor is A Great Idea

"A mentor is someone who allows you to see the hope inside yourself."

— Oprah Winfrey

Introduction:

The tax industry is constantly evolving, and staying updated with the latest changes can be a challenge, even for seasoned tax professionals. In recent years, we’ve seen significant shifts in tax laws, technological advancements, and increased client expectations. Whether you’re new to the industry or have been preparing taxes for years, understanding these changes is crucial to your success. But how do you navigate this complex landscape? The answer: having a mentor.

The Evolving Tax Landscape

1. Changes in Tax Laws

Every year, the IRS rolls out new regulations, changes to existing laws, and updates to tax forms. Recent changes have included updates to tax brackets, modifications to deductions, and the introduction of new credits. For example, the expansion of the Child Tax Credit and updates to the Earned Income Tax Credit have impacted millions of taxpayers. Keeping up with these changes is vital to ensure accurate tax preparation and to maximize your clients’ returns.

2. Technology and Automation

The tax industry has seen a significant increase in the use of technology and automation tools. From cloud-based tax software to AI-driven tax preparation tools, the landscape is shifting towards efficiency and accuracy. While these tools can make your job easier, they also require a certain level of tech-savviness and an understanding of how to integrate them into your practice effectively.

3. Increased Client Expectations

Clients today expect more from their tax preparers. They want personalized service, quick turnaround times, and year-round tax advice. With more competition in the market, it’s essential to not only meet but exceed these expectations. This requires a blend of technical knowledge, customer service skills, and ongoing education.

Why Having a Mentor is Crucial

Given the complexities of the modern tax industry, having a mentor can make a significant difference in your career. Here’s why:

1. Personalized Guidance

A mentor offers personalized advice based on your unique situation. Whether you’re struggling with understanding new tax laws, choosing the right software, or dealing with difficult clients, a mentor can provide the insight you need. They’ve been through the challenges you’re facing and can offer solutions that are tailored to your needs.

2. Staying Current

Tax laws are always changing, and it can be overwhelming to keep up with them on your own. A mentor who is actively engaged in the industry can help you stay updated on the latest changes. They can guide you through the nuances of new regulations and help you apply them in your practice.

3. Building Confidence

Starting out as a tax professional can be daunting. A mentor provides the support and encouragement you need to build confidence in your abilities. They can help you avoid common pitfalls, share best practices, and provide constructive feedback that helps you grow.

4. Expanding Your Network

A mentor often comes with a network of other professionals in the industry. By connecting with a mentor, you also gain access to this network, which can open doors to new opportunities, partnerships, and collaborations. Networking is a key component of building a successful tax practice, and a mentor can facilitate these connections.

5. Long-Term Success

Mentorship isn’t just about getting through the next tax season; it’s about building a sustainable and successful career. A mentor can help you develop a long-term strategy for your business, including goals for growth, ongoing education, and client retention. They can also provide guidance on how to adapt to changes in the industry over time.

Conclusion

The tax industry is ever-changing, and staying on top of these changes is crucial for your success. While technology and automation can help, nothing replaces the value of personalized guidance from an experienced mentor. Whether you’re just starting out or looking to take your tax practice to the next level, having a mentor can provide the support, knowledge, and confidence you need to thrive in this dynamic industry.

If you’re ready to take your tax career to new heights, consider finding a mentor who can guide you through the complexities of the tax world. Your future success may depend on it.

Stay in the Loop.

Subscribe to our newsletter for exclusive tips, resources, and updates on new courses.

Facebook

Instagram

LinkedIn

TikTok