WHY CHOOSE THE TAX SCHOOL DROP OUT?

TAX SOFTWARE THAT WORKS AS HARD As You Do

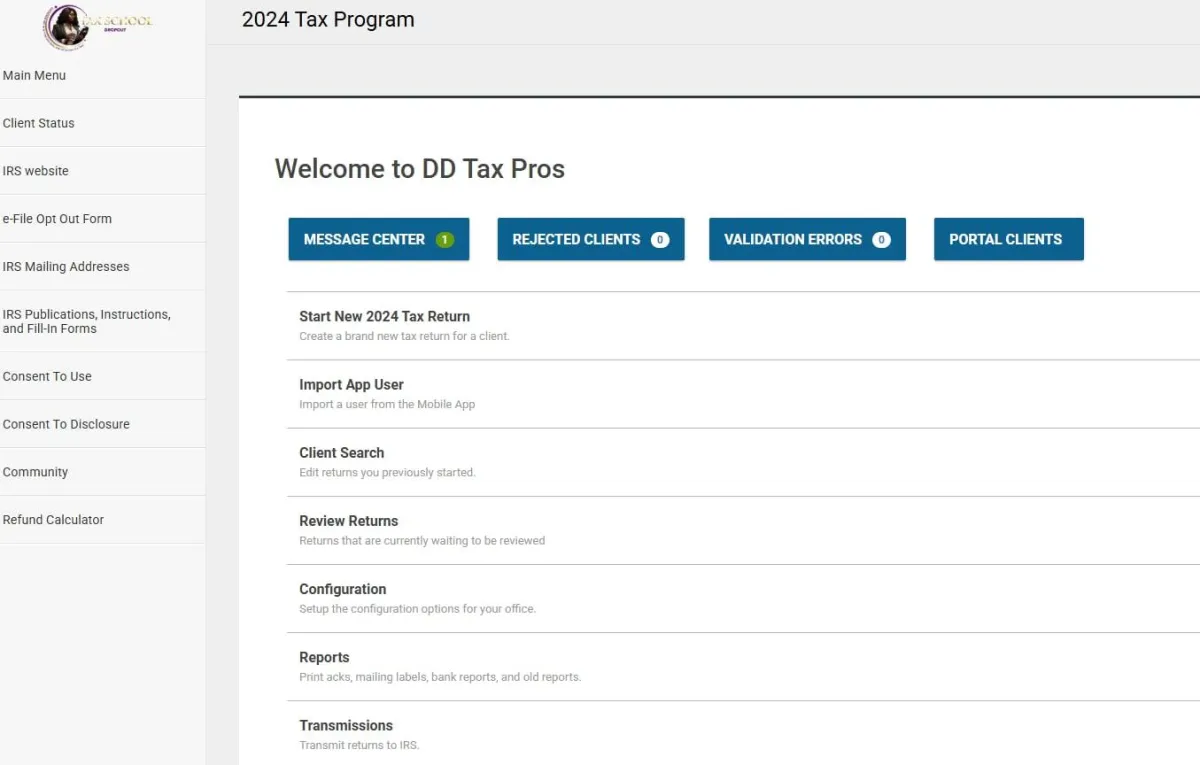

Stop overpaying for complicated software. Our all-inclusive platform gives you everything you need to start earning.

✓ Seamless Federal & State Integration

✓ Automatic IRS Updates

✓ User-Friendly Interface

✓ Lowest Backend Fees in the Industry

✓ Mobile-Ready Design

"I made back my $250 investment with my first client" - Thomas J., $10K/month earner

Expert Training, Zero Fluff

Skip the textbooks. Learn exactly what you need to succeed - nothing more, nothing less.

• Step-by-Step Video Tutorials

• Real-World Case Studies

• Live Q&A Sessions

• Updated Tax Law Guides

• Business Marketing Templates

24/7 Support That

Has Your Back

Never feel stuck again. Get answers when you need them, not when it's convenient for us.

• Round-the-Clock ERO Support

• Live Chat Assistance

• Expert Tax Guidance

• Community of Tax Pros

• Weekly Success Calls

"The support team helped me land my first

10 clients!" - Sarah W., $5.5K/month earner

Real Stories, Real Success.

Thomas James, Atlanta, GA

“Before this program, I had zero experience in the tax industry, but within just 90 days, I went from clueless to earning $10,000 a month. The skills I gained have completely transformed my financial future and set me on a path I never thought possible!"

Sarah William, Houston, TX

“I spent years in a corporate job, but it never gave me the fulfillment or freedom I craved. This program changed all of that. In just one tax season, I replaced my entire salary, gained financial independence, and now I have the work-life balance I’ve always wanted.”

Bob Limones, Miami, FL

“I had enrolled in several other tax training programs before, but none of them gave me the real-world skills I needed to succeed. This program was a game-changer – it actually provided me with the tools and knowledge I needed to start earning and building a business in this industry.”

Featured Blog Posts

Recent Changes in the Industry and Why Having a Mentor is A Great Idea

The tax industry is constantly evolving, and staying updated with the latest changes can be a challenge, even for seasoned tax professionals. In recent years, we’ve seen significant shifts in tax laws... ...more

News

August 29, 2024•3 min read

Stay in the Loop.

Subscribe to our newsletter for exclusive tips, resources, and updates on new courses.

Facebook

Instagram

LinkedIn

TikTok